Financial Analysis

Introduction:

Financial institutions have incentives the use of AI and machine learning for satisfying their business needs. We offer AI powered machine learning solutions for predicting and forecasting the future trends in financial sector. Our machine learning algorithms make use of customer database and historical transactions to identify the profit and loss patterns in banking and insurance sector. Therefore banks are investing heavily on these cutting edge technologies AI and ML for obtaining operational efficiencies by reducing the losses.

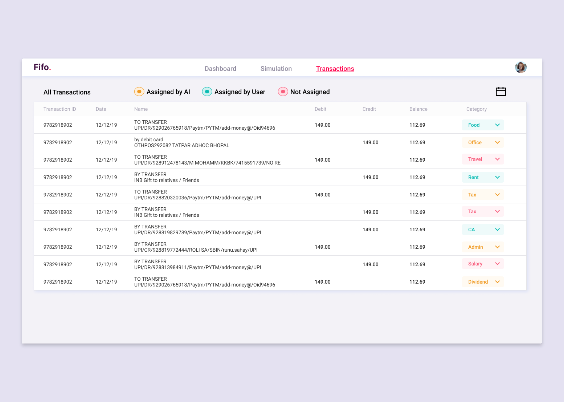

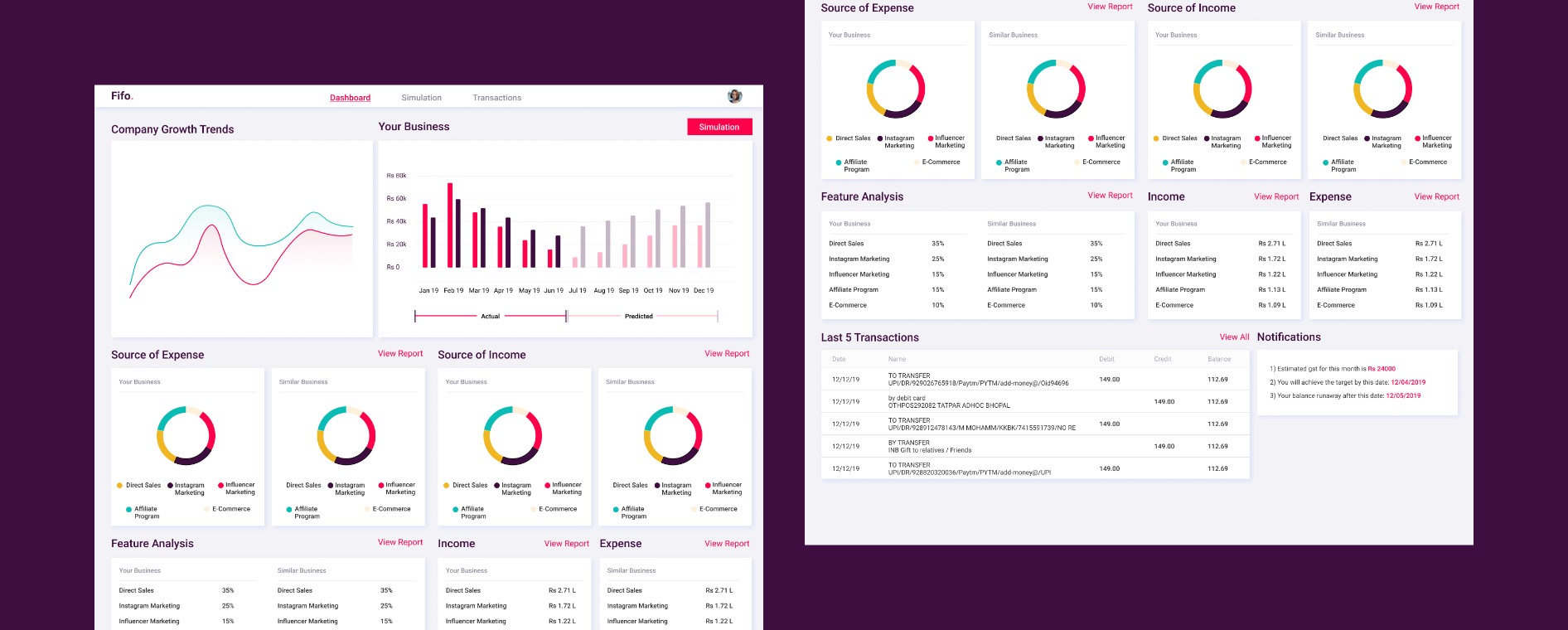

- Enhanced customer experience:Based on past transactions and behaviour, ML develops a better understanding of customers and their behaviour. This help banks to customize financial products and services by adding different features and intuitive interactions to deliver meaningful customer engagement and build strong relationships with its customers.

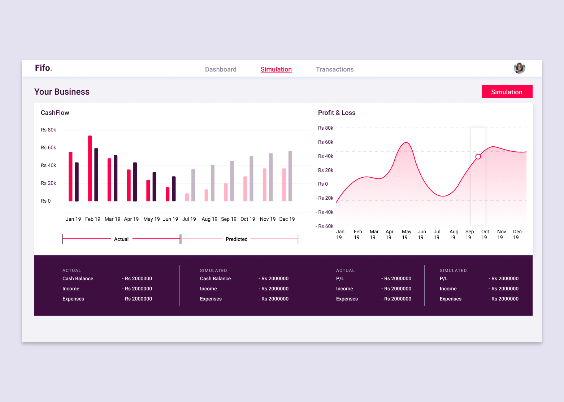

- Prediction of future outcomes:With its power to predict future scenarios and profit and loss by analyzing past behaviors, AI helps banks predict future outcomes and trends. This helps banks to identify fraud, detect anti-money laundering pattern and make customer recommendations.

- Fraud Detection:Biggest loss for the banking sector is NPA. According to the past data ,AI and ML able to predict suspicious transactions, Fraud detection and bank loan defaulters.

- Effective Decision Making as per the insights : With the help of available data pattern we can make different Machine Learning models which will help banks to make effective decisions for the operations, customer engagement and customer retention.